SEO Case Study: Early-Stage Growth for a New Holiday Accommodation Website

Launching a new accommodation website is one of the most challenging environments for SEO. Search results are dominated by global booking platforms, long-established holiday homes, and directory-style listings with years of authority behind them.

This SEO Case Study examines how a brand-new accommodation website gained early search visibility and competitive keyword traction through correct SEO foundations, entity clarity, and booking distribution strategy - without relying on paid advertising, backlinks, or ongoing SEO manipulation.

It focuses on what was done, when it was done, and how Google responded, providing a realistic view of early-stage SEO performance in a highly competitive accommodation market.

Project overview

The Client

The Bach in Mangawhai

Industry

Holiday accommodation (OTA-dominated, highly competitive)

Website project details

Website launch: 1 December 2025

Services provided

Full Website build, copy and strategic content

SEO foundations & structural SEO optimisation

Booking platforms support & channel manager setup (freeonlinebooking.com)

Google Analytics and Google Console set up

Introduction

Launching a new accommodation website in New Zealand is one of the most challenging SEO environments to enter. Search results are dominated by global booking platforms, long-established holiday homes, and directory-style listings with years of authority behind them.

This case study outlines how a brand-new accommodation website achieved early visibility, competitive keyword movement, and sustained growth through correct SEO foundations, entity clarity, and distribution strategy — without relying on paid advertising, backlinks, or ongoing SEO manipulation.

What influenced the results

SEO foundations prioritised early

Strategic copy (content written with ideal client in mind)

Booking platforms supported demand while SEO matured

The challenge

The Bach in Mangawhai launched into the market with several inherent disadvantages:

Search results dominated by Booking.com, Airbnb, Bookabach, and VRBO

Long-established competing properties with aged domains and booking histories

A brand-new website with no authority, backlinks, or history

Launching late directly into the December–January peak holiday period

The goal was not instant page-one domination, but to:

Establish clear entity recognition with Google

Achieve early traction on high-intent accommodation searches

Build a foundation for sustainable long-term growth, including direct bookings

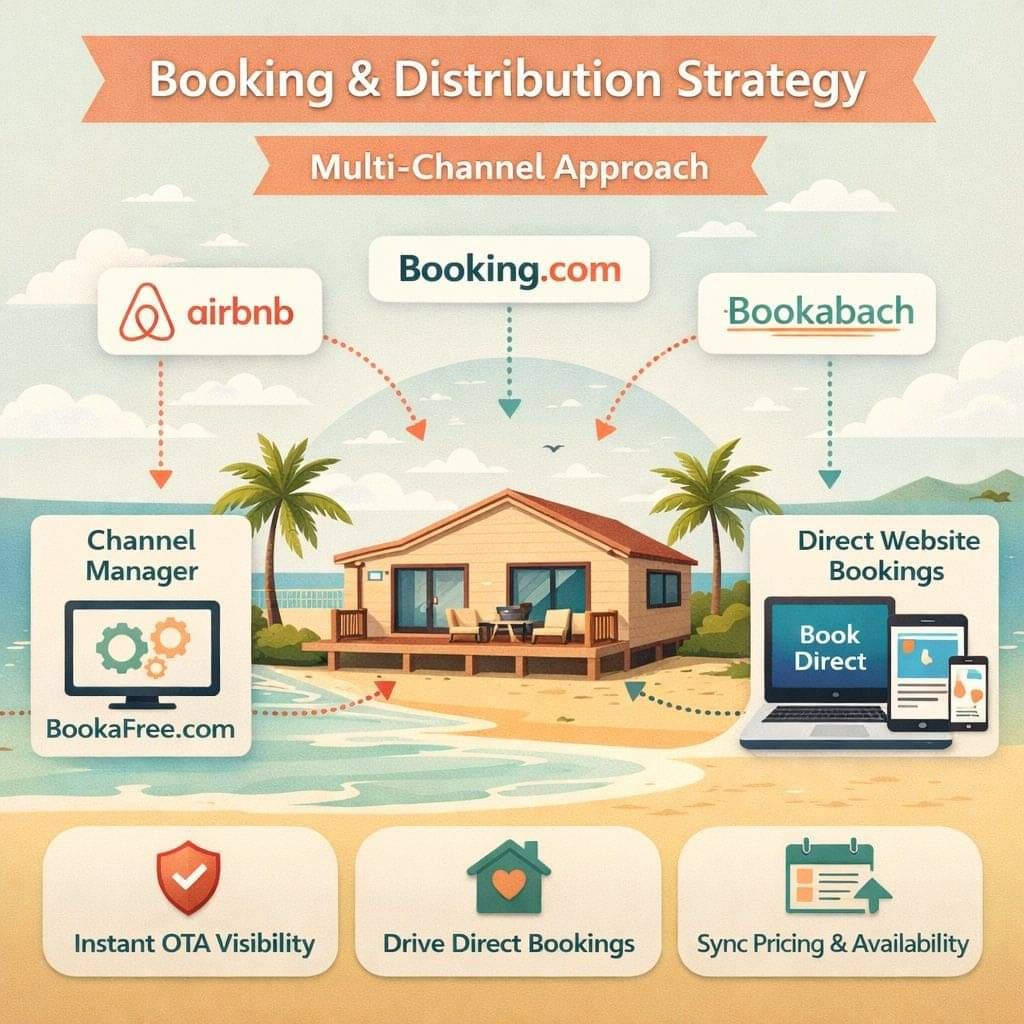

Booking & distribution strategy (foundation work)

Alongside the website build, a core focus was setting up booking infrastructure and distribution to ensure the property was visible and bookable from day one.

This included:

Setup and configuration of a channel booking manager (FreeOnlineBooking)

Assistance with listing and alignment across key booking platforms:

Airbnb

Booking.com

Bookabach

Connection between the website’s direct booking system and third-party platforms to prevent double bookings and availability conflicts

Strategic intent:

Use established booking platforms for immediate visibility and trust

Support direct website bookings as a long-term objective with incentives to book direct cheaper

Maintain consistency in pricing, availability, and messaging across channels

This ensured the property could compete operationally while SEO foundations matured organically.

The Project Phases

Strategically designed over 3 phases to test SEO impacts.

Phase 1 — Launch foundations (1–20 December)

At launch, the website already included:

Clear, human-focused website copy

Well-written meta titles and descriptions

Logical page intent and hierarchy

Mobile-first design

No advanced structural SEO had been applied at this stage.

This period established a true SEO baseline, while accounting for early “warm traffic” from friends and family sharing the site.

Phase 2 — Structural SEO & entity alignment (21 December)

On 21 December, targeted SEO improvements were applied, including:

Structured data (schema)

Alignment between the website and Google Business Profile

Improved entity clarity for Google

No changes were made to:

Website copy

Page layout

Internal linking

Site structure

This allowed performance changes to be attributed specifically to machine-readable SEO improvements, rather than content or design updates.

Phase 3 — Confirmation window (1–17 January)

From 1–17 January:

No SEO changes were made

No website changes occurred

Launch-phase sharing had tapered off

This window was used to confirm whether the December gains would hold and continue organically, rather than spike temporarily.

Performance Analysis (Google Search Console)

Visibility growth (normalised by days)

Period | Dates | Days | Homepage | Impressions |

|---|---|---|---|---|

Baseline | 1–20 Dec | 20 | 234 | 11.7 |

SEO impact | 21–31 Dec | 11 | 273 | 24.8 |

Confirmation | 1–17 Jan | 17 | 466 | 27.4 |

Result: Impressions per day more than doubled immediately following the SEO updates and continued to rise through January without further changes.

Query Expansion (how Google Understood the site)

Period | Ranking Queries |

|---|---|

1-20 Dec | 16 |

21-31 Dec | 31 |

1-17 Jan | 32 |

This shows Google:

expanded how it tested the site

retained and widened visibility

continued building confidence over time

High-intent accommodation search movement

Search Query | Early Dec | Late Dec | to Mid Jan |

|---|---|---|---|

bach mangawhai | 9.7 | 3.3 | 2.5 |

mangawhai bach | 21.7 | 12.0 | 6.1 |

bach stay mangawhai | not visible | 13 | 7.8 |

the bach in mangawhai (brand) | not ranking | #1 | #1 |

These are competitive, OTA-dominated searches where movement is typically slow for new sites.

Additional high-intent search movement

(Post-21 December SEO updates, confirmed through January)

Following the structural SEO updates applied on 21 December, Google expanded testing beyond core bach keywords into broader accommodation and booking-intent searches

Several commercially relevant phrases moved from non-visibility into page-two and page-one-edge positions in the weeks immediately after the update

These included variations related to “bach stay Mangawhai,” holiday homes, and booking-style queries

While many of these terms remain OTA-dominated, rankings were retained and gradually improved, rather than dropping out of visibility

This behaviour continued through early–mid January, despite no further SEO or website changes

The pattern indicates growing entity confidence, with Google increasingly associating the site not only with branded searches, but with the wider Mangawhai accommodation landscape

For a brand-new accommodation website, this depth and persistence of query testing reflects healthy early-stage SEO traction, not isolated keyword wins

CTR behaviour (important context)

Early December CTR was elevated due to launch-phase warm traffic

CTR softened as Google widened impressions into broader, more competitive searches

This is a healthy SEO pattern, indicating expanded reach rather than declining relevance

Device & location signals

Mobile accounted for the majority of clicks and engagement

New Zealand was the dominant country by a wide margin

Visibility remained tightly aligned with local search intent

This confirmed: correct localisation, strong mobile usability, accurate intent matching

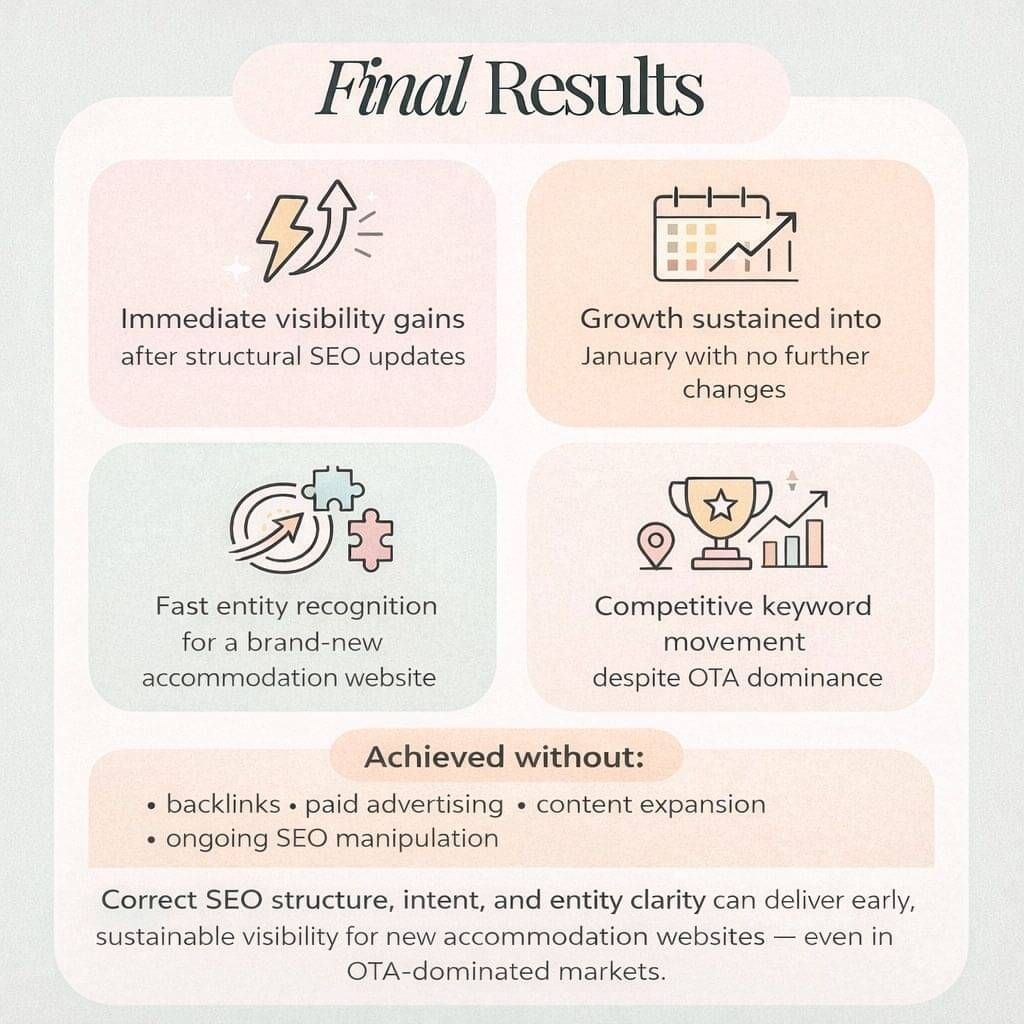

SEO Case Study Results

Structural SEO updates triggered immediate visibility gains

Growth was sustained into January with no further changes

Fast entity recognition achieved for a brand-new accommodation website

Competitive keyword movement occurred despite OTA dominance

Importantly:

no backlinks

no paid advertising

no content expansion

no ongoing SEO manipulation

Key takeaway:

Correct SEO structure, intent, and entity clarity can deliver early, sustainable visibility for new accommodation websites — even in OTA-dominated markets.

Looking for a website build with strategic SEO set up?